Why More Businesses Are Choosing to Buy Their Own Premises Instead of Renting

In recent years, there’s been a noticeable shift in how businesses approach their operational spaces. More business owners are opting to purchase their premises rather than renting. This trend reflects a deeper understanding of long-term financial benefits, greater operational control, and the opportunity to invest in a valuable asset that enhances the stability of their business. Let’s explore why this shift is occurring, the benefits of ownership, and how Renown Lending can help finance your next business purchase.

The Appeal of Owning Business Premises

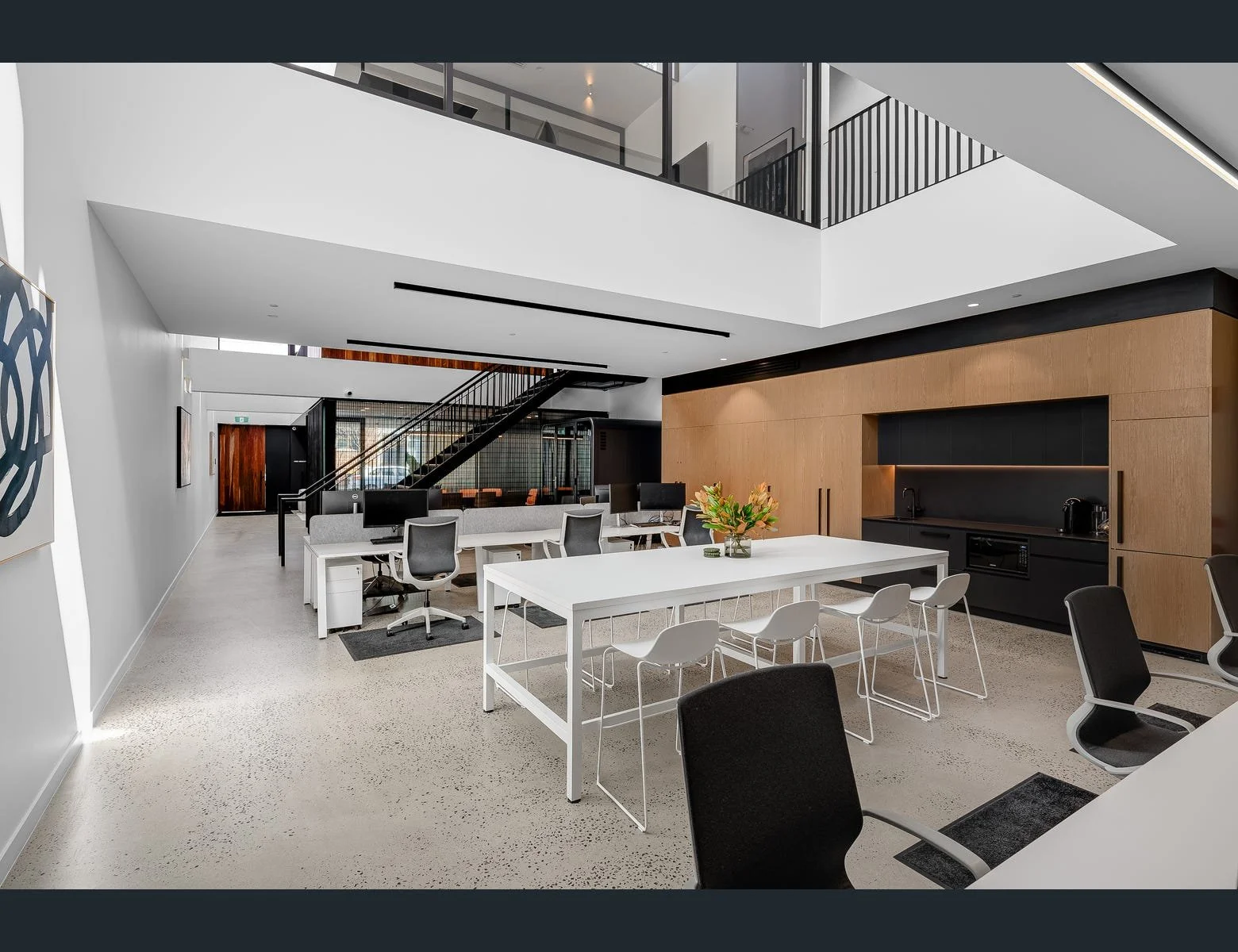

For many business owners, purchasing a property like 10 Sydney Place, Adelaide—a stunning architectural masterpiece with premium finishes and strategic location—is no longer just a dream; it’s becoming a strategic decision.

Building Equity: Owning a commercial property allows business owners to build equity over time, creating a valuable asset that appreciates, rather than continuing to pay rent without any return.

Cost Predictability: With ownership, businesses avoid the uncertainty of rent increases. Fixed mortgage repayments provide stability, allowing for more accurate financial planning.

Tax Benefits: In Australia, there are significant tax advantages to owning business premises, including deductions for interest payments, depreciation, and other expenses.

Customisation & Branding: When you own your space, you have the freedom to customise and brand it to reflect your company’s identity, creating a stronger connection with clients and employees.

No Stamp Duty on Commercial Properties (SA): In South Australia, business owners benefit from no stamp duty on commercial property purchases, reducing upfront costs.

Why Are Business Owners Making the Move?

Investment Potential: Business premises double as a real estate investment. Owners can lease out portions of the property or sell it at a profit in the future.

Operational Control: Ownership eliminates the dependency on landlords, giving business owners control over modifications, lease terms, and overall property management.

Future Security: As businesses grow, owning a space ensures stability and the capacity to expand without worrying about relocation challenges.

For example, a property like 10 Sydney Place, Adelaide, with its premium 370 sqm layout, prime location near Adelaide CBD, and flexibility for client and employee needs, perfectly illustrates why businesses are making the leap.

The Benefits of Using Renown Lending for Commercial Property Finance

At Renown Lending, we understand that purchasing a commercial property is a significant decision for any business. That’s why we offer tailored financing solutions designed to meet your unique needs.

Competitive Rates and High LVRs: We provide attractive loan-to-value ratios, allowing you to borrow more against the property’s value.

Flexible Loan Terms: Choose loan terms ranging from 3 to 36 months, with amounts from $20K to $40M.

Fast Approvals: Our streamlined processes mean you can secure financing quickly, giving you a competitive edge in the property market.

Minimal Documentation: We reduce the paperwork burden, ensuring a smooth and hassle-free experience.

Interest Options: Choose between capitalised or prepaid interest to match your financial strategy.

Property-Backed Finance: We cater to all property types and locations, ensuring flexibility in financing solutions.

Why Renown Lending is the Right Choice for Your Business

Whether you’re looking at properties like 10 Sydney Place or exploring other opportunities, Renown Lending is here to simplify your journey. With our experience and dedication, we ensure that your business investment is supported by a strong financial foundation.

Reach out to us today to discuss your next purchase and take the first step toward building long-term success. Don’t miss out on a property that could transform your business. Contact Chet Al at Knight Frank Adelaide to view 10 Sydney Place, and let Renown Lending handle the rest.